New Mortgage Rules: A Path to Affordable Homeownership

Owning a home is a significant milestone for many Canadians, representing stability and financial security. However, rising mortgage costs have made this dream more difficult to achieve. Thankfully, new government regulations are offering hope, making homeownership more attainable, particularly for first-time buyers.

30-Year Mortgage Amortizations: A Game-Changer for New Builds

As of August 1, 2024, first-time homebuyers purchasing new builds can now qualify for 30-year insured mortgage amortizations. This means buyers can spread their payments over a longer period, significantly lowering monthly mortgage costs and making homeownership more accessible. The government is encouraging more Canadians to explore newly constructed homes, including condos, as a solution to the ongoing housing shortage.

Expanding the Benefits: More Homes, More Opportunity

By December 15, 2024, the 30-year mortgage amortization option will be extended to all first-time buyers and those purchasing new builds. This expanded eligibility reduces the cost of monthly payments, making it easier for more Canadians to enter the housing market.

Another important update is the increase in the price cap for insured mortgages, which will rise from $1 million to $1.5 million, also effective December 15, 2024. With housing prices continuing to climb, this change reflects current market realities, allowing more buyers to qualify for insured mortgages with a down payment of less than 20%.

Increasing Competition for Better Mortgage Deals

In addition to these reforms, the government is boosting competition in the mortgage market. The Canadian Mortgage Charter now allows insured mortgage holders to switch lenders at renewal without having to go through a new mortgage stress test. This gives homeowners more flexibility to find the best mortgage deals when it's time to renew, ultimately saving money by encouraging competition.

Building Toward a Fairer Housing Market

These reforms are part of a larger effort to create a fairer and more accessible housing market. Alongside the new mortgage rules, the government has released blueprints for both a Renters' Bill of Rights and a Home Buyers’ Bill of Rights. These initiatives aim to protect buyers and renters from unfair practices, making the housing market more transparent and equitable for everyone.

What This Means for You

If you’ve been thinking about purchasing a home, these new rules offer a significant opportunity, particularly for those interested in new builds. With reduced monthly payments, an increased price cap for insured mortgages, and more flexibility in choosing mortgage lenders, now is an excellent time to explore your options.

Ready to Take the Next Step?

If these changes have sparked your interest in purchasing a new build or exploring homeownership, I’m here to help. As a dedicated real estate professional, I can guide you through the process and ensure you take full advantage of these new mortgage rules. Reach out today to start your homeownership journey in this evolving market!

30-Year Mortgage Amortizations: A Game-Changer for New Builds

As of August 1, 2024, first-time homebuyers purchasing new builds can now qualify for 30-year insured mortgage amortizations. This means buyers can spread their payments over a longer period, significantly lowering monthly mortgage costs and making homeownership more accessible. The government is encouraging more Canadians to explore newly constructed homes, including condos, as a solution to the ongoing housing shortage.

Expanding the Benefits: More Homes, More Opportunity

By December 15, 2024, the 30-year mortgage amortization option will be extended to all first-time buyers and those purchasing new builds. This expanded eligibility reduces the cost of monthly payments, making it easier for more Canadians to enter the housing market.

Another important update is the increase in the price cap for insured mortgages, which will rise from $1 million to $1.5 million, also effective December 15, 2024. With housing prices continuing to climb, this change reflects current market realities, allowing more buyers to qualify for insured mortgages with a down payment of less than 20%.

Increasing Competition for Better Mortgage Deals

In addition to these reforms, the government is boosting competition in the mortgage market. The Canadian Mortgage Charter now allows insured mortgage holders to switch lenders at renewal without having to go through a new mortgage stress test. This gives homeowners more flexibility to find the best mortgage deals when it's time to renew, ultimately saving money by encouraging competition.

Building Toward a Fairer Housing Market

These reforms are part of a larger effort to create a fairer and more accessible housing market. Alongside the new mortgage rules, the government has released blueprints for both a Renters' Bill of Rights and a Home Buyers’ Bill of Rights. These initiatives aim to protect buyers and renters from unfair practices, making the housing market more transparent and equitable for everyone.

What This Means for You

If you’ve been thinking about purchasing a home, these new rules offer a significant opportunity, particularly for those interested in new builds. With reduced monthly payments, an increased price cap for insured mortgages, and more flexibility in choosing mortgage lenders, now is an excellent time to explore your options.

Ready to Take the Next Step?

If these changes have sparked your interest in purchasing a new build or exploring homeownership, I’m here to help. As a dedicated real estate professional, I can guide you through the process and ensure you take full advantage of these new mortgage rules. Reach out today to start your homeownership journey in this evolving market!

Categories

Recent Posts

Top Reasons Homebuyers Are Investing in Presales

Understanding Foreclosures and Court-Ordered Sales: What You Need to Know

New Mortgage Rules: A Path to Affordable Homeownership

Maximizing Your Presale Investment: Key Strategies for Savvy Buyers

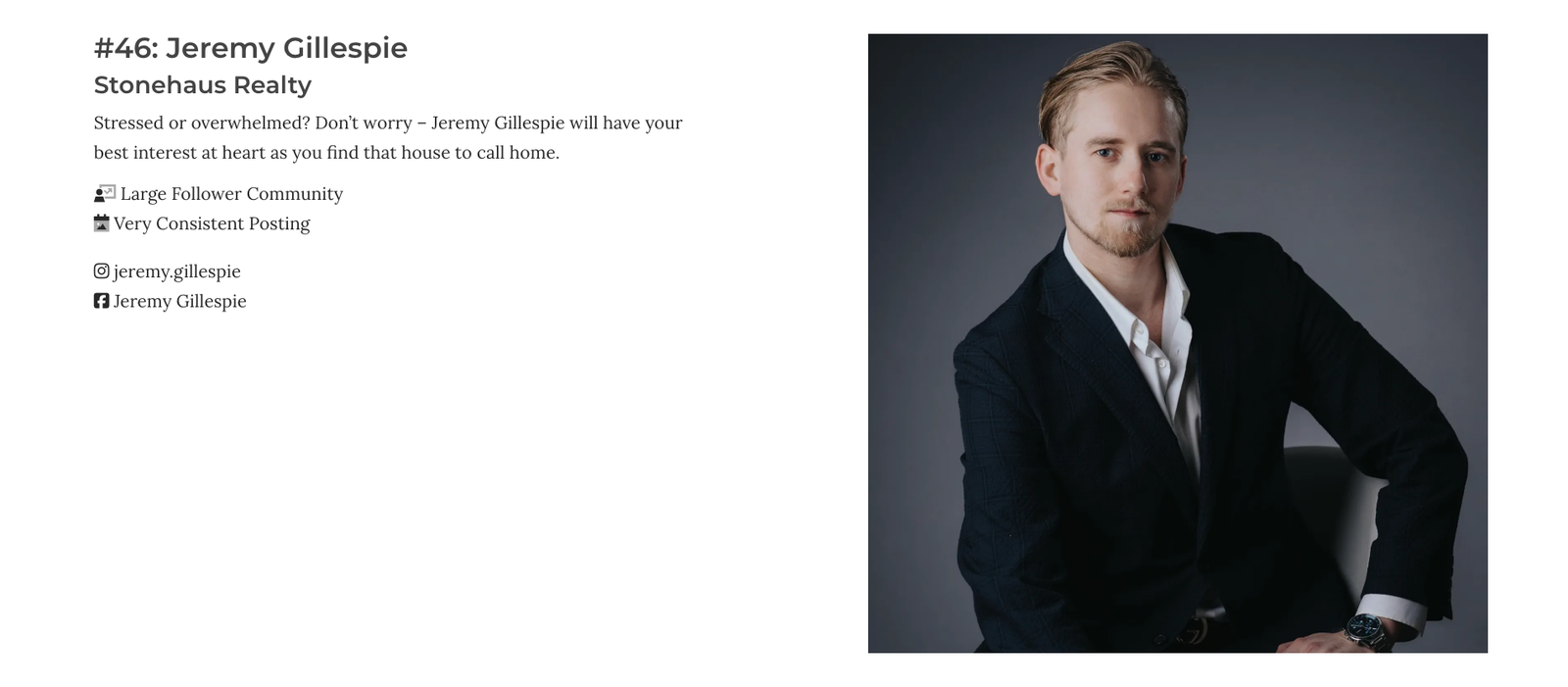

Jeremy Gillespie Named Among Top 100 Real Estate Agents in British Columbia on Social Media!

Presale vs. Resale Condos: Which is the Best Option for You?

What is a Presale Condo Assignment? A Guide for Buyers and Sellers in British Columbia